Table of Contents

“Top 20 Powerful Reasons to Invest in the RBC Canadian Dividend Fund for Long-Term Growth and Income”

Introduction

Let’s face it: investing can feel like a gamble if you don’t know where to put your money. But what if there was a steady, proven option with the potential for regular income and growth? That’s where the RBC Canadian Dividend Fund shines.

This fund isn’t just another mutual fund. It’s designed to give you access to some of Canada’s most stable, high-performing companies while delivering steady dividend income. Whether you’re just starting out or planning your retirement, this fund checks a lot of boxes.

What Is the RBC Canadian Dividend Fund?

The RBC Canadian Dividend Fund is a professionally managed mutual fund that focuses on high-quality Canadian companies known for paying regular dividends. Its goal? To provide investors with a mix of income and capital growth through strategic investments in strong, dividend-paying businesses.

The Power of Dividend Investing

Why are dividend funds so popular? Here’s the deal:

- Dividend income is reliable, even when the markets are rocky.

- When reinvested, those dividends compound, boosting your returns over time.

- Dividend-paying companies often have strong financials and solid management.

It’s like having a steady paycheck while your investment keeps growing behind the scenes.

20 Reasons the RBC Canadian Dividend Fund Stands Out

1. Long-Term Stability

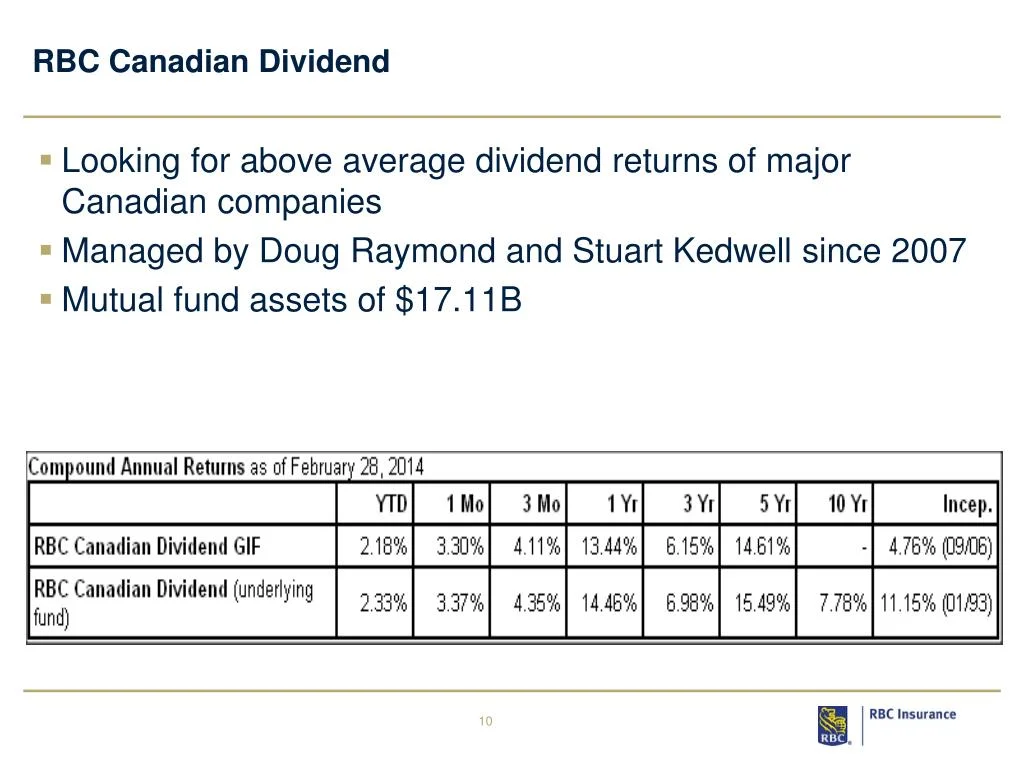

This fund has been around for decades—and for good reason. It delivers consistent returns that make it a long-term winner.

2. Reliable Dividend Income

You can count on regular income distributions, which is a game-changer for anyone looking for passive income or retirement support.

3. Professional Management

The fund is managed by seasoned professionals who have deep knowledge of the Canadian market. That’s peace of mind right there.

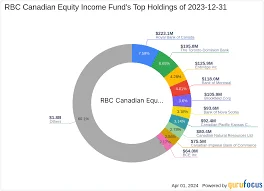

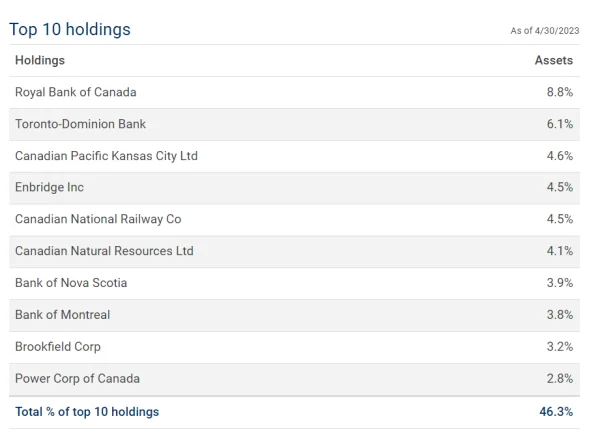

4. Exposure to Leading Canadian Companies

From banks to utilities to telecom giants, the fund holds blue-chip stocks that are the backbone of the Canadian economy.

5. Ideal for Retirement Portfolios

Planning for retirement? This fund works beautifully in RRSPs, TFSAs, and RRIFs.

6. Diversification Benefits

You’re not putting all your eggs in one basket. The fund spreads investments across various sectors, reducing your overall risk.

7. Strong Track Record

Past performance doesn’t guarantee the future—but let’s be real, the fund’s track record is impressive.

8. Capital Appreciation Potential

Dividend income is just one part. The underlying stocks have room to grow in value, too.

9. Focus on Financial Strength

The fund selects companies with strong cash flow and low debt—aka financially sound investments.

10. Lower Volatility

Dividend-paying stocks are typically more stable, which means less stress during market dips.

11. Tax Efficiency

Dividends often enjoy favorable tax treatment in Canada, especially in non-registered accounts.

12. Monthly or Quarterly Income Options

Choose how often you want your income—monthly or quarterly payouts available.

13. Investor-Focused Philosophy

Everything about this fund is designed for the long-term investor in mind.

14. Cost-Effective Management Fees

It’s not the cheapest, but you get great value for the reasonable management expense ratio (MER).

15. Reinvestment Opportunities

Want to grow your investment faster? Use the DRIP program to automatically reinvest dividends.

16. Inflation Hedge

Because dividend income can grow over time, it helps fight off the effects of inflation.

17. Ethical and ESG Considerations

RBC increasingly considers Environmental, Social, and Governance (ESG) factors in fund decisions.

18. Accessibility for All Investor Types

With a relatively low minimum investment, it’s open to both beginners and pros.

19. Solid Support From RBC

One of Canada’s most trusted financial institutions backs this fund. That means reliable customer service and tools.

20. Transparency and Reporting

You’ll always know where your money’s going with detailed reports and clear updates.

Who Should Invest in the RBC Canadian Dividend Fund?

This fund is perfect for:

- Long-term investors

- Retirees seeking regular income

- Newbies who want a low-risk introduction to the market

- Anyone tired of low savings account interest

If you’re looking for both growth and income, this could be your new favorite investment.

How to Start Investing in the RBC Canadian Dividend Fund

Getting started is easy:

- Open an account with RBC or through your advisor

- Choose your contribution type: lump sum or recurring

- Set your risk tolerance

- Review your investment quarterly

You can also set it up through your online banking platform or investment portal.

Tips for Maximizing Your Returns

- Reinvest your dividends through DRIP

- Contribute regularly to benefit from dollar-cost averaging

- Hold in a TFSA or RRSP for tax advantages

- Review and rebalance your portfolio annually

Conclusion

The RBC Canadian Dividend Fund isn’t just another mutual fund—it’s a smart, stable, and income-focused solution that fits almost any portfolio. With 20 solid reasons to invest, it’s easy to see why Canadians trust this fund to deliver value over time. Whether you’re looking for steady income, long-term growth, or both, this fund has your back.

FAQs

1. Is the RBC Canadian Dividend Fund good for beginners?

Yes, it offers stability and professional management—great for first-time investors.

2. How often are dividends paid out?

Dividends are typically paid monthly or quarterly, depending on your account settings.

3. Can I hold this fund in a TFSA or RRSP?

Absolutely! It’s a popular choice for both tax-sheltered accounts.

4. What’s the risk level of the fund?

Moderate. It’s less volatile than growth funds but still subject to market fluctuations.

5. Is there a minimum investment amount?

Yes, usually around $500–$1000, depending on the platform or account type.

Leave a Reply