Table of Contents

“20 Powerful Reasons to Invest in the RBC Select Balanced Portfolio Today”

Introduction

Looking to invest but feeling overwhelmed by all the options out there? You’re not alone. With the ever-changing financial landscape, many Canadians are turning to trusted names and simplified solutions. One such gem? The RBC Select Balanced Portfolio.

This investment option combines expert management, broad diversification, and a balanced risk profile — perfect for those who want to grow their money without losing sleep. Let’s dive deep into what makes this fund tick and why it might be your next best financial move.

Understanding the Basics

What Does “Balanced Portfolio” Mean?

A balanced portfolio typically mixes both stocks (equities) and bonds (fixed income) to strike a middle ground between risk and reward. Think of it as the Goldilocks of investing — not too risky, not too conservative.

Who Is RBC?

Royal Bank of Canada (RBC) is one of the country’s largest and most reputable financial institutions. Their investment division, RBC Global Asset Management, handles billions in assets with a keen eye for performance and safety.

Overview of the RBC Select Portfolios Family

The RBC Select Portfolios range includes options for different risk tolerances: Conservative, Balanced, Growth, Aggressive Growth, and Very Conservative. The Balanced Portfolio sits squarely in the middle, offering a healthy blend of equities and fixed income.

Key Features of the RBC Select Balanced Portfolio

Diversified Asset Allocation

You’re not putting all your eggs in one basket. This portfolio invests in both Canadian and global equities and bonds, offering a nice hedge against regional downturns.

Professionally Managed Funds

RBC’s investment professionals actively manage the portfolio, rebalancing and tweaking as needed based on market conditions. You don’t need to lift a finger.

Risk Level: Medium

Perfect for those who want moderate growth with moderate risk. It won’t skyrocket like crypto, but it also won’t crash and burn at the same pace.

Suitable Investment Time Horizon

Ideal for those with a 3–5+ year horizon, whether you’re saving for a home, a child’s education, or building wealth for retirement.

Performance and Returns

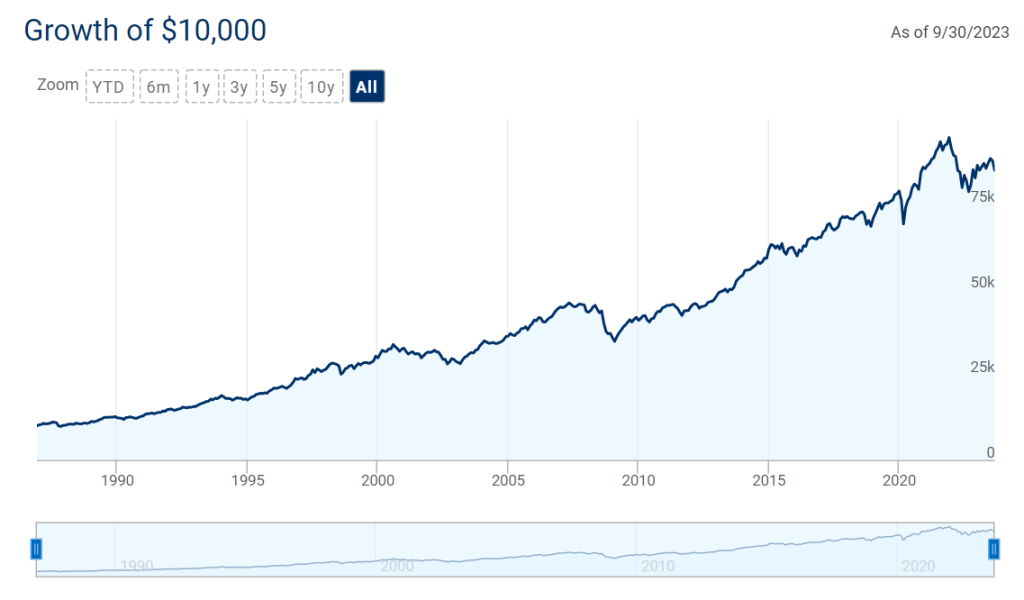

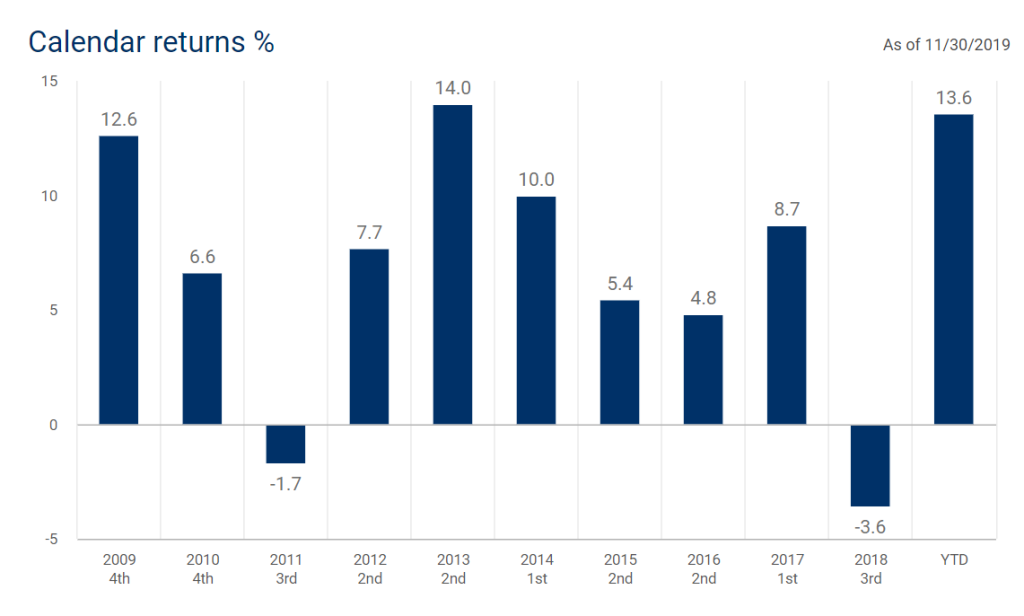

Historical Returns Snapshot

Over the past decade, the RBC Select Balanced Portfolio has delivered steady annualized returns between 4% to 7%, depending on market cycles — solid performance for a medium-risk investment.

Comparison with Other Investment Options

When stacked against high-fee mutual funds or volatile single-stock picks, the balanced approach tends to win in the long run, especially when factoring in peace of mind.

Volatility vs. Reward

While not immune to market dips, the RBC Select Balanced Portfolio bounces back faster due to its diversified setup.

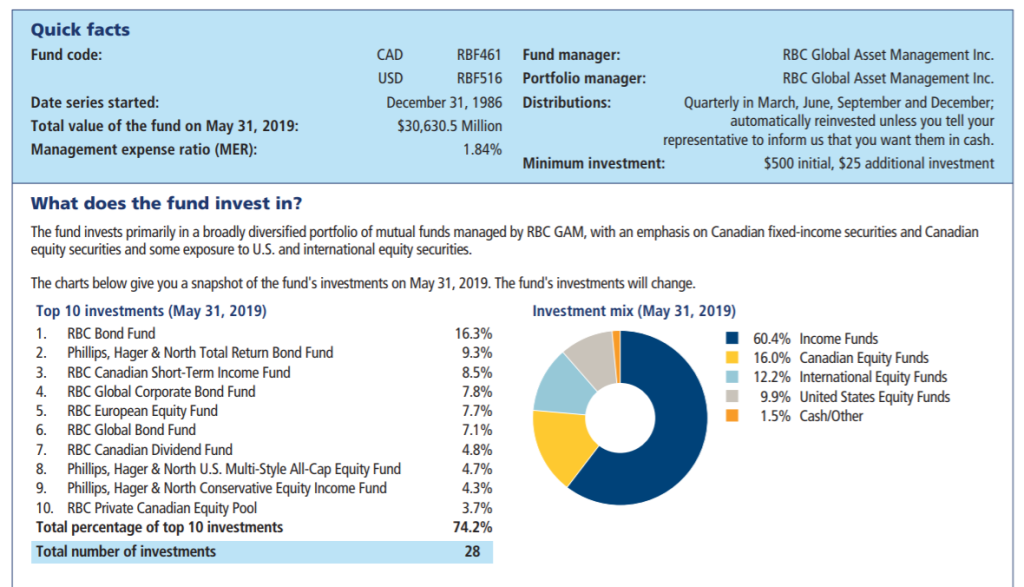

Composition of the Portfolio

Equity Holdings

Roughly 40% to 60% of the portfolio is in equities, including Canadian, U.S., and international stocks. This gives you access to global growth.

Fixed Income Holdings

The rest is in fixed income — government and corporate bonds that provide stability and income during turbulent times.

Geographic Allocation

Expect a solid chunk in Canada, with the rest spread across U.S., Europe, Asia, and emerging markets — truly global exposure.

Benefits of Investing in RBC Select Balanced Portfolio

Simplicity and Convenience

One fund. Diversified. Professionally managed. That’s a triple win for busy investors.

Tax Efficiency

RBC structures the portfolio to minimize tax drag — a plus if you’re holding it in a non-registered account.

Long-Term Growth Potential

You’re riding on the backs of global growth trends without the need for day-to-day trading or market timing.

Who Should Invest in This Portfolio?

New Investors

If you’re new to investing and unsure where to start, this fund offers a “plug-and-play” solution.

Conservative Risk Takers

Not ready to go all-in on stocks but want more than savings account interest? This is your sweet spot.

Retirement Savers

A great core holding in a TFSA, RRSP, or RESP, especially if you’re a few years from retirement.

How to Start Investing

Opening an RBC Direct Investing Account

You can sign up online in minutes. Choose your account type (TFSA, RRSP, etc.) and add the RBC Select Balanced Portfolio to your holdings.

Using a Financial Advisor

Prefer the personal touch? RBC advisors can guide you based on your financial goals and timelines.

Automated Contributions

Set up pre-authorized monthly contributions to build wealth consistently — a strategy called dollar-cost averaging.

Fees and Costs

MER (Management Expense Ratio)

As of the latest data, the MER for the RBC Select Balanced Portfolio is around 1.89%. It covers professional management and operational costs.

Are the Fees Justified?

Considering you’re getting a globally diversified, actively managed fund with a solid track record — yes, many would argue it’s worth it.

Expert Opinions & Ratings

Analyst Reviews

Top financial analysts rate RBC’s Select Portfolios among the best in their class for reliability and consistency.

Customer Testimonials

“Switched to RBC Balanced Portfolio three years ago, and I’ve seen stable growth with less stress!” — Mark L., Vancouver

Real-World Case Study

Meet Sarah: A Young Professional’s Investing Journey

At 29, Sarah wanted to invest her bonus without risking everything. Her advisor suggested the RBC Select Balanced Portfolio. Three years later, her investment has grown 18%, and she’s now confident enough to explore other asset classes too — while keeping her balanced fund as the core.

Tips to Maximize Portfolio Value

Rebalancing Strategies

Even though RBC handles this, reviewing your entire portfolio annually ensures it aligns with changing goals.

Pairing with Other Investments

Consider adding high-interest savings or GICs for short-term goals while keeping this fund for mid- to long-term growth.

Common Myths Debunked

“Balanced Portfolios Are Boring”

They’re not flashy, but they’re consistent. And consistency is what builds wealth.

“Too Conservative for Growth”

Over 10+ years, the RBC Select Balanced Portfolio has outperformed many high-risk individual investors. Slow and steady often wins.

Risks to Consider

Market Fluctuations

No investment is risk-free. Equities can drop during recessions, but the bond portion often cushions the blow.

Inflation Risk

All investments should be evaluated against inflation. The RBC Select Balanced Portfolio is structured to outpace inflation over time.

Future Outlook

Economic Trends Impacting Balanced Portfolios

With global economies stabilizing post-COVID, balanced portfolios are expected to thrive — especially those with international exposure.

RBC’s Commitment to Sustainable Investing

RBC is increasingly integrating ESG principles (Environmental, Social, Governance), making this portfolio a responsible choice too.

Conclusion

The RBC Select Balanced Portfolio is an excellent choice for Canadian investors seeking a reliable, well-diversified, and professionally managed fund. Whether you’re new to investing or looking to stabilize your portfolio, this fund offers the best of both worlds — growth and security. So why wait? Start building your financial future with a portfolio that truly balances your goals and your peace of mind.

FAQs

1. What’s the difference between RBC Select Balanced and Conservative?

The Conservative version holds a higher percentage of bonds, offering lower risk and lower potential returns than the Balanced version.

2. Can I hold the RBC Select Balanced Portfolio in my TFSA or RRSP?

Absolutely. It’s a popular choice for both accounts due to tax benefits and growth potential.

3. How often does RBC rebalance the portfolio?

RBC regularly rebalances the portfolio to maintain its target asset mix — typically every quarter or when market shifts demand.

4. Is this portfolio suitable for young investors?

Yes! It offers steady growth with moderate risk, ideal for those starting their investment journey.

5. Can I withdraw anytime?

Yes, but withdrawals from registered accounts (like RRSPs) may have tax implications. Consult a financial advisor for guidance.

Leave a Reply